Consumer Information

808-334-0234

Fax: 808-334-0191

natalie@maunaloahelicopters.edu

Contact information for individual agencies that offer financial assistance can be found here.

Privacy of Student Records−Family Educational Rights and Privacy Act (FERPA)

FERPA stands for the Family Education Rights and Privacy Act of 1974. This law protects the privacy of student education records from kindergarten through graduate school. FERPA applies to all schools that receive funds through an applicable program of the U.S. Department of Education, and thus most postsecondary schools are covered by FERPA.

FERPA requires that education records be kept confidential. Records may be disclosed with the consent of the student, if the disclosure meets one of the statutory exemptions, or if the disclosure is directory information and the student has not placed a hold on release of directory information.

Students at MLH may request a copy of their records at any time. Students have a right of access to their records (but not necessarily the right to a copy of the record) and a right to request the correction of records that are inaccurate or misleading. If the school denies this request for correction of a record, the student may request a hearing.

Institutions must give students annual notice of their rights under this law, and most institutions accomplish this by having in place a student record policy.

The statute defines the phrase “education record” broadly as “those records, files documents, and other materials which 1) contain information directly related to a student; and 2) are maintained by an educational institution.

Digital records are covered by FERPA.

Facilities and Services for Students with Disabilities

MLH is dedicated to providing reasonable accommodation to its flight school students with documented disabilities who request assistance. Individual flight school student needs are addressed with regard to specific disabilities, academic and career goals, learning styles and objectives for personal development. Campus-specific services include academic advising, assistance with registration, advising on time-management skills, study and testing skills, arrangement of group study and facilitation of physical access.

FAA-certified programs are subject to regulation requirements by the FAA. Therefore, due to regulatory requirements, persons with certain disabilities may be limited or delayed in participation or licensure in the flight training programs.

Students interested in MLH programs are encouraged to contact us for information regarding eligibility concerns. All information is confidential and not included in the student’s academic records.

Student Diversity

The following Student Diversity information is based June 2011 enrollment in our Professional Pilot Program.

Gender

Male: 90%

Female: 5%

Race/Ethnicity

Self-Identified Members of a Major Racial or Ethnic Group:

Asian/Pacific Islanders: 14%

White: 61%

Hispanic/Latino: 5%

American Indian/Alaskan: 10%

Other: 10%

For more information about student diversity at Mauna Loa Helicopters, call 1-808-334-0234

Price of Attendance

Net Price Calculator

Refund Policy and Requirements for Withdrawal and Return of Federal Financial Aid

Refund Policy

Withdrawal Policy: Students have the right to withdraw from the program at any time during their training. Notice of withdrawal must be requested to the administration office. If a student withdraws owning money this money must be paid immediately, or the student risks being sent to collections. If a student withdraws having a positive accounts balance, the refund will be processed according to policy. A student enrolled in the Professional Pilot Program who do not attend classes for more than 90 consecutive days and do not submit a leave of absence request, will be considered a withdrawal from the program.

Mauna Loa Helicopters maintains a 100% pro-rata refund policy: supplying a full refund policy for all unused training funds. Refunds need to be requested to the accounts department and will be issued within 45 days of the student's request unless uncleared checks are pending. All funds that have been supplied by a lender will be issued in the manner prescribed by the individual financial institution. All merchandise purchases are non-refundable. The $150 enrollment fee is only refundable if requested within three days after signing the enrollment agreement and making an initial payment.

All costs associated with the issuance of an international visa will be retained. Any student enrolled in the Professional Pilot Program and considered a dropout or termination will have all refunds automatically refunded within 30 days of last class attendance or official drop or termination date.

Title IV students who do not attend classes for more than 14 consecutive days and do not submit a leave of absence request, will be considered a withdrawal from the program.

Refund of Title IV Funds for Federal Aid Students

The law specifies how a school must determine the amount of Title IV funds that a student earns if they withdraw from the program. When a student withdraws before completion of the program, the Title IV program assistance that has been earned up to that point is determined by a specific formula. If a student received (or the school or student’s parents received on student’s behalf) less assistance than what was earned, a student may be able to receive those additional funds. If a student receives more assistance than earned, the excess funds must be returned by the school and/or student.

The amount of assistance earned is determined on a pro-rata basis. For example, if 30% of the program hours were completed when withdrawal occurs, then 30% of the Title IV financial aid for the payment period would be earned. A student will have earned 100% of the Title IV financial aid disbursed for the payment period or period of enrollment if the student withdrew after completing more than 60% of the scheduled program hours.

Once the amount of Title IV financial aid that was not earned has been calculated, federal regulations require that the school return Title IV funds disbursed in the following order:

- Unsubsidized Federal Stafford Loans

- Subsidized Federal Stafford Loans

- Unsubsidized Direct Stafford Loans (other than PLUS loans)

- Subsidized Direct Stafford Loans

- Federal PLUS/Grad PLUS Loans

- Direct PLUS Loans

If a student did not receive all of the funds that were earned, a student may be due a Post-withdrawal disbursement. If a Post-withdrawal disbursement includes loan funds, the school must get your permission before disbursing them. A student can choose to decline some or all of the loan funds to avoid incurring additional debt. If there are outstanding fees owed to the school, the school may ask to use the Post-withdrawal disbursement toward these fees. The school cannot apply your Post-withdrawal disbursement without a student’s permission; however in most cases it is in a student’s best interest to allow the school to keep the funds to reduce your debt at the school.

There are some Title IV funds that cannot be disbursed after withdrawal because of other eligibility requirements. For example, a first-time, first-year undergraduate student who has not completed the first 30 days of their program before withdrawal will not receive any FFEL or Direct Loan funds that would have been received had they remained enrolled past the 30th day.

If a student receives (or the school, or student’s parent receive on student’s behalf) excess Title IV program funds that must be returned, the school must return a portion of the excess equal to the lesser of:

- Student’s Institutional charges multiplied by the unearned percentage of funds received, or

- The entire amount of the student’s excess funds.

If the school is not required to return all of a student’s excess funds, the student must return the remaining amount. Any loan funds that must be returned may be repaid in accordance with the terms of the promissory note.

If it is determined that a Title IV credit balance exists, the balance will be returned to the student within 14 days after the Return to Title IV calculation is complete, unless the University has a signed student authorization allowing the University to return the credit balance to the direct loan program to reduce the student’s loan debt.

The requirements for Title IV program funds when a student withdraws are separate from any refund policy that the school has. Therefore, a student may still owe funds to the school to cover unpaid institutional charges. The school may also collect from a student for any Title IV program funds that the school was required to return.

If you have any questions about your Title IV program funds, you can call the Federal Student Aid Information Center at 1-800-4-FEDAID (1-800-433-2343). TTY users may call 1-800-730-8913.

Textbook Information

MLH students will be required to buy various books and publications which they will utilize throughout their training. Many are available online, through the school or in free .pdf version from the FAA website.

Educational Program

Instructional Facilities

Faculty

Transfer of Credit Policies and Articulation Agreements

Flight School Student Hours and Credits

Students with prior flying experience may be eligible for credit toward the hourly requirement established for each FAA pilot certificate or rating. Credit that may be assigned is governed by Federal Aviation Regulations 141.77(b). The transferability of credits earned at this institution is at the discretion of the accepting institution. It is the student’s responsibility to confirm whether credits will be accepted by another institution of the student’s choice.

Articulation Agreement

MLH holds no articulation agreement with other flight schools.

Accreditation, Approval and Licensure of Institution and Programs

Copyright Infringement-Policies and Sanctions

Unauthorized distribution of copyrighted materials, including School documents, and unauthorized peer-to-peer file sharing may subject the student to civil and criminal liabilities.

Copyright infringement is the act of exercising, without permission or legal authority, one or more of the exclusive rights granted to the copyright owner under section 106 of the Copyright Act (Title 17 of the United States Code). These rights include the right to reproduce or distribute a copyrighted work. In the file-sharing context, downloading or uploading substantial parts of a copyrighted work without authority constitutes an infringement.

Penalties for copyright infringement include civil and criminal penalties. In general, anyone found liable for civil copyright infringement may be ordered to pay either actual damages or “statutory” damages affixed at not less than $750 and not more than $30,000 per work infringed. For “willful” infringement, a court may award up to $150,000 per work infringed. A court can, in its discretion, also assess costs and attorneys’ fees. For details, see Title 17, United States Code, Sections 504, 505.

Willful copyright infringement can also result in criminal penalties, including imprisonment of up to five years and fines of up to $250,000 per offense.

For more information, please see the Web site of the U.S. Copyright Office at www.copyright.gov, especially their FAQ’s at www.copyright.gov/help/faq.

Computer Use and File Sharing

Students found to have violated the policies of academic integrity, including copyright infringement with respect to unauthorized peer-to-peer file sharing, including illegal downloading or unauthorized distribution of copyrighted materials using the institution’s information technology system, may receive the following sanctions including a failing grade on the assignment, probation, or dismissal from the School.

Student Activities

Life at Mauna Loa Helicopters

MLH operates 365 days per year. We welcome all students and make every effort to ensure that each student’s transition into life at our school is easy and comfortable.

Student Activities

There are many off-campus activities that provide a way for students to have fun while training in Hawaii. Scenic valleys, expansive beaches, exotic rainforests, hiking, sailing, fishing, surfing, snorkeling, diving, sight seeing…even erupting volcanoes. To us, Hawaii is an incredible place to live.

Student Services

Student services are available to help students with their transition to Hawaii and Mauna Loa Helicopters. Students will receive a welcome packet including maps, essential phone numbers, and information to help the student get acclimated. Pick up from the airport is available with adequate notice.

Student Housing

We offer dormitory style housing. If students prefer to live off campus, we can recommend several off-campus apartment options at all locations. Housing is $650 per month with a $600 security deposit on Kona.

Our staff can answer any questions parents or students may have concerning housing.

Stay Connected

• Facebook: We have an active Facebook page and Instragram page where students and families are encouraged to keep in touch online.

• Maunaloahelicopters.edu: We regularly update the News section of our website.

• Mail: Students can receive mail and packages while training at MLH. Please note that we cannot forward mail for students from this business address. Students using this address will need to contact all senders and notify them of their change in address. For this reason we encourage students to look into a P.O. box or private mail box.

Career and Job Placement Services

Mauna Loa Helicopters offers career-minded students assistance finding their first job. The school prefers to hire instructors from its own graduate pool. This depends on the demand at the time and upon the individual’s performance and professionalism. The school hires 70% – 80% of its graduates from the Professional Pilot Program.

There are many types of financial aid available to MLH students. These include:

Federal Student Loans

Sallie Mae Financial

Sallie Mae Scholarships

AOPA

Pilot Finance, Inc.

Utah Valley University

Alaska Advantage Program

Helicopter Foundation International

Veterans Educational Benefits

For information on assistance other than Federal Student Loans, please click here.

Federal Student Loans

Mauna Loa Helicopters is accredited by ACCSC and approved by the Department of Education to offer certain Title IV loan programs such as Direct Loans and Plus Loans. Mauna Loa is proud to be the first independent helicopter school in the country able to offer federal financial aid to their students. Independent students can qualify for up to approximately $5,000 in federal loans. Dependent students who qualify for the Parent Plus Loan can borrow up to the full tuition cost for the Professional Pilot Program and expenses.

Federal loans are low-interest government subsidized loans to assist students who are enrolled at least half time. Under the Direct Loan program, the Federal government now insures these loans.

1. Subsidized loans-a student must have financial need. Students will not be charged any interest before the repayment period begins or during authorized periods of deferments.

2. Unsubsidized loans-are not awarded on the basis of need. Students will be charged interest from the time the loan is disbursed until it is paid in full. Students will have the option of paying the interest while in school or allowing it to accrue.

3. Parent PLUS loans-enable parents, or a parent, with good credit histories to borrow money in order to pay the education expenses of each child in the family classified as a dependent undergraduate student enrolled at MLH at least half time.

You can learn all about these exciting programs by going to www.fafsa.ed.gov

How to apply for Federal Student Loans

To apply for Title IV aid, a student must complete the Free Application for Federal Student Aid (FAFSA). The application must be completed with extreme care and accuracy. The application will be transmitted electronically to a central processor, which will calculate the Expected Family Contribution (EFC) according to the Federal Needs Analysis and run the information through various edits. MLH is available to answer any questions students may have about the FAFSA. The FAFSA is used to determine eligibility for all types of Title IV programs. The funds available to the student will depend on the EFC and the cost of attendance.

For more information on applying for Federal Student Loans contact MLH at (808) 334-0234. Click here to download Steps to Financial Aid.

To apply for the parent plus loan, parents can go to studentloans.gov, sign in, and go to “Complete the PLUS Request Process.”

Institutional Code of Conduct for Educational Loans

Ethical considerations regarding student financial are important to MLH. There are no revenue-sharing arrangements with any lender of any kind. The act of receiving gifts from a lender, a guarantor, or loan servicer is prohibited. There will be no contract arrangements providing financial benefit from any lender of affiliates of a lender. Loan certifications will not be delayed or refused, and MLH prohibits the directing of borrowers to particular lenders. No funds will be offered as private loans. There is no financial aid assistance to office staff, and no compensation to any advisory boards in contact MLH.

Title IV Policies & Procedures

Please review our Title IV Policies and Procedures Manual for more information.

Preferred Lender Arrangements

MLH has no preferred lenders.

Mauna Loa Student Catalog

View our student catalog here

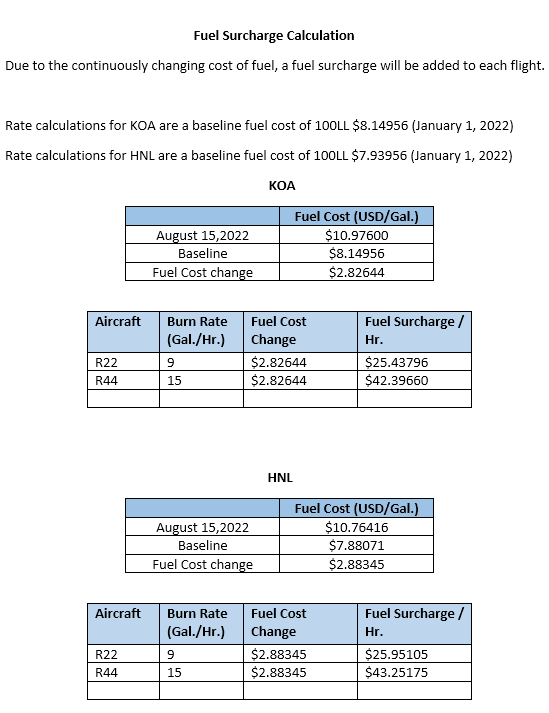

Mauna Loa Helicopters and Mauna Loa Aero have been monitoring the cost of aviation fuel very carefully. Fuel prices have been increasing rapidly since 2021, inflation is at a 40-year high and all of Mauna Loa’s supply chains have been adversely affected. Since January 1, 2022 the cost of fuel has increased by $2.83 per gallon in Kona and $2.88 per gallon in Honolulu. To put that price change in perspective for the average R22 and R44, that’s a cost increase of $25.44 and $42.40 per hour of operation.

Mauna Loa has been absorbing the increases in operating costs since our last rate increase in October of 2021. We now find, that to continue to provide the quality training our students expect, a price increase is necessary.

Mauna Loa Helicopters has decided to implement an hourly fuel surcharge rather than a permanent rate increase. Fuel prices will be monitored weekly and for full transparency, the calculation of the fuel surcharge will be posted at the school. Fuel prices will be reviewed each Tuesday (Air Service price changes are made each Tuesday) and the fuel surcharge per hour will be updated in FBO each Wednesday.

Should the volatility of fuel prices stabilize, Mauna Loa Helicopters and Mauna Loa Aero will set a new baseline rental price for all aircraft and remove the fuel surcharge.

We believe this is the fairest and most transparent way to address the increase and current volatility in fuel prices.

We appreciate your business and thank you for training with Mauna Loa.

Example of weekly notice:

Graduation and Job Placement Rates

Below are some important rates, as prescribed by the SRKCS and 34 CFR § 668.6(b). All data is taken from the 2023-2024 enrollment period and include only full-time students in the Professional Pilot Program.

- Full-time Graduation Rate: 92%

- Full-time Job Placement Rate for Graduates: 92%

- Part-time Graduation Rate: 80%

- Part-time Job Placement Rate for Graduates: 88%

- Graduation overall rate: 92%

- Placement overall rate: 100%

Job Placement for Graduates

At MLH, we’re passionate about helping our students learn how to fly, and we focus on achieving two main goals:

• Training students how to be the most knowledgeable, safe and sought-after pilots in the aviation industry.

• Helping MLH graduates find work and succeed in the industry

MLH maintains an excellent employment rate for their students after graduation. Hear what our alumni have to say over at the Mauna Loa alumni page.

While MLH offers no formal job placement for students, we do everything in our power to assist our instructors in finding their first jobs in the industry. Immediately after graduation we have had great success in assisting their placement in exciting industries throughout the world.

Graduation Rate and Transfer-out Rate for Students Receiving Athletically Related Student Aid

Not applicable.

Program name: Professional Pilot Program

Updated for 2024

This program is designed to be completed in 12-18 months. This program will cost $98,000.00–$110,000 if completed within the normal timeline. There may be additional costs for living expenses, books, headsets, written tests, check ride fees, etc.

These costs were accurate at the time of posting but may have changed.

Of the students who completed this program within normal time, the typical graduate leaves with $ 98,871.54 of debt.

The program meets licensure requirements in the following States: Hawaii

For more information about graduation rates, loan repayment rates, and post-enrollment earnings about this institution and other postsecondary institutions please visit collegescorecard.ed.gov.

As required by the Higher Education Act of 1965 (HEA), as amended by the Higher Education Opportunity Act of 2008, MLH encourages those meeting voter registration guidelines to register to vote and participate in the democratic process for all federal and state elections.

Voter registration qualifications include:

• 17 1/2 years of age register; 18 years of age to vote

• U.S. citizen

• Hawaii Resident

Voter registration forms may be found at:

http://hawaii.gov/elections/voters/registration.htm

Unlike grants or work-study, a loan is money that must be repaid. You, the student borrower, are legally obligated to repay your loans so we encourage you to fully read and understand the terms and conditions before accepting a loan. Please note: You must repay your loans even if you do not complete your program.

The minimum requirements for obtaining a federal loan are a completed FAFSA application, admission into a degree-seeking program, and at least half-time enrollment. At MLH, we encourage students to make informed decisions when taking out a student loan. Only borrow the amount of funds that you need to successfully complete your education.

Federal Loans to Parents

If a dependent student needs funds to meet their estimated cost of attendance, parents can request a Parent Plus Loan to cover remaining educational expenses. Parents must contact MLH to find out about how to apply for a Parent Plus Loan.

A loan is money that must be repaid. You, the parent, are legally obligated to repay your loans so we encourage parents to fully read and understand the terms and conditions before accepting a loan. Please note: You are responsible to repay your parent loans even if your student does not complete their program.

Master Promissory Note

A valid Master Promissory Note (MPN) needs to be established before any Federal loans are disbursed to the student’s account. As defined by the USDE, the MPN is a “legal document in which you promise to repay your loan(s), any accrued interest and fees to the USDE. It also explains the terms and conditions of your loan(s).

It is important to understand that Direct LoansSM are just that: loans. It’s highly important these loans be paid back after graduation. MLH encourages each student to visit the United States Department of Education (USDE) website at www.StudentLoans.gov to complete the MPN and Entrance/Exit counseling sessions. The U.S. Department of Education further advises the MPN must be signed in one session and take 30 minutes to complete.

Initial Loan Counseling for Student Borrowers

Federal regulations mandate that all Direct Loan borrowers receive Entrance Counseling before their loan can be processed. This requirement can be fulfilled by either completing the entrance counseling on the VFAO website, or by doing the on-line counseling available on the Direct Loan website at www.dl.ed.gov. Failure to attend an entrance counseling session or perform the on-line counseling will result in the cancelation of the loan. The student will be responsible for the outstanding tuition balance.

Per the DOE website:

Entrance Counseling will walk you through the Direct Loan process and explain your rights and responsibilities as a borrower. All first time Direct Loan borrowers must complete entrance counseling before their loans can be disbursed.

In this process, you will learn about the following:

1. Direct LoansSM

2. Managing your educational expenses

3. Other financial resources to consider that may help pay for your education

4. Your rights and responsibilities as a borrower

Subsidized and Unsubsidized

There are two main types of Stafford Direct LoansSM: subsidized and unsubsidized. A student with a subsidized loan will not have interest accrued on their borrowing until the expiration of the six-month grace period. The grace period for student loans starts after successful completion or discontinuation of the MLH program. Students obtaining unsubsidized loans will have the interest accrued on the borrowings during the educational and grace period. Students of unsubsidized loans have the option of paying any accrued interest while attending MLH.

Grace Periods

Grace periods vary between each type of loan. All loan grace periods start after a student graduates or leaves MLH for any reason. The allotted amount of time as a grace period for Federal Stafford Direct LoansSM is six months. PLUS loan borrowers are subject to repayment the date of full disbursement. The first payment on PLUS loans is due within 60 days after the final disbursement. However, a parent PLUS borrower who is a student themselves can defer repayment while still enrolled at least half-time at a qualified school. Also, for PLUS loan disbursements made after July 1, 2008, the borrower can defer for an additional six months after the borrower is no longer enrolled at least half-time. Any accrued interest not paid by the borrower during deferment will be capitalized with the loan.

Payments

The DOE wants all students to be aware that all Direct LoansSM are real loans, and need to be repaid. They are just as real as car loans or mortgages. Everyone borrowing Federal student loans is expected to make their loan payments in full and on time, according to their repayment schedule. Failure to do so will result in default. It is important to note the student has an obligation to repay the full amount of the loan. This is true whether or not the student completed the program, is unable to find employment upon completion, is dissatisfied with the course, or does not receive the educational or other services purchased from MLH.

The DOE’s Entrance Counseling Guide for Direct Loan Borrowers provides sample student budgets and repayment schedules.

Repayment Plans and Other Options

Depending on which repayment plan is used, each student has generally 10 to 25 years to repay their student loans. The student has different options available to repay their student loans upon their due date.

The website from the DOE has an estimated repayment calculator for student to use. Questions about repaying Direct LoansSM should be directed to the loan servicer. Information regarding the loan servicer is available at www.nslds.ed.gov.

Common repayment plans:

Standard repayment – This option allows the student to pay a fixed amount until all of the student loans are paid in full. The minimum monthly payment will be $50.00, and are allowed up to 10 years to repay the loan.

Since the loans are to be paid in the shortest period of time, the monthly payment under the standard plan may be higher than with other options. However, since a ten-year time frame is used, the student may also pay the least amount of interest.

Extended repayment – An extended repayment plan allows for a fixed annual or graduated repayment amount for no more than 25 years. Qualified students must have more than $30,000 outstanding in Direct LoansSM. This plan is beneficial to students in need of a lower monthly payment. While the monthly loan payments will be lower, the interest has a longer period of time to accumulate. Thus, the student will ultimately pay more under this option.

Graduated repayment – This plan starts payments out low and increases them every two years with a repayment period of ten years. This payment plan is ideal for students who expect their income to rise steadily over time. The monthly payment will not be less than the amount of interest that accrues between payments. While the monthly payments will increase over time, no single payment will be greater than three times that of any other.

Income Contingent Repayment (ICR) – This plan is for borrowers of Direct LoansSM only. This provides the most flexibility for Direct LoanSM repayment without causing financial difficulties. Every year, the monthly loan payment is calculated on the basis of the student’s Adjusted Gross Income (AGI, plus the spouse’s income for married couples), family size, and the total amount of the Direct LoansSM. The ICR plan will allow your monthly loan payment to be the lesser of:

1. The amount paid if repaid in 12 years multiplied by an income percentage factor which varies with the annual income, or

2. 20 percent of the student’s monthly discretionary income.

The unpaid portion of accumulated loan interest will be capitalized (added to the loan principle) once each year, if the student’s payments do not cover it. Capitalization of interest will not exceed 10 percent of the original amount due when the student entered the repayment period. Interest will continue to accumulate, but no longer be capitalized.

In an ICR plan, 25 years is the maximum repayment period. If the loans have not been fully repaid under this plan, the unpaid portion will be discharged. Time spent in deferment or forbearance does not apply. However, the student may have to pay taxes on the discharged amount.

The DOE provides more information on Income Based Repayment on the IBR Fact Sheet.

More information on repayment options can be found in the publication Funding Education Beyond High School: The Guide to Federal Student Aid. A copy of this publication is available in the main office or on the on-line at the DOE website.

Electronic Payments

Some student may be eligible for a reduction in interest rate by enrolling in electronic debiting. Along with receiving a student loan statement electronically, a student can make a loan payment on-line or opt for recurring loan payments through electronic debit. The student’s bank can make an automatic debit from a checking or savings account. These payments are sent to the loan holder for processing.

There are advantages in using an electronic debit system. It’s convenient and efficient, payments will always be on time, and there is no need to remember to mail a monthly check. To sign up for electronic debit, please contact your loan servicer.

Payment Difficulties

- If the student finds it difficult to repay their student loans, they are strongly encouraged to contact their loan servicer as soon as possible. The loan servicer will help determine the best course of action regarding the loan repayment. Option available are:

- Modifying/Changing repayment plans.

Requesting a deferment, provided certain requirements are met. Deferments allow the student to temporarily stop making loan payments. - If eligibility requirements for a deferment are not met, the student may request a forbearance. In certain situations, a forbearance allows a student to temporarily stop making payments on the loan, temporarily make them smaller, or extend the time available for repayment.

If no action is made to rectify the problem of non-payment, then the student loan could go into default. This creates serious consequences.

Default

For Federal Financial Aid purposes, default means the failure to make payments on student loans according to the terms of the MPN. The MPN is considered a binding legal document authorized at the time of loan. MLH, the financial institution that made or owns the loan, the loan guarantor, and Federal government have the authority to take action to recover any money owed. Some consequence of default include:

- National credit bureaus can be notified of your default, which will harm your credit rating. In the future, this will make it more difficult to buy a car or house.

- The student will be ineligible for additional Federal Student Aid, if there is any decision to return to school.

- Loan payments can be deducted from your paycheck.

- State and Federal income tax refunds can be withheld and applied toward the amount owed.

- Late fees and collection costs will be assessed on top of what is owed.

- The student can face legal action.

If a student loan is in default, more information is available at the Department of Education’s Default Resolution Group website.

Loan Forgiveness for Public Service Employees

Students employed in a public service job may have the balance of the loans forgiven, if 120 on-time monthly payments are made under certain repayment plans after October 1, 2007. Eligible students must be a full-time public service employee during the same period of time the qualified payments are made and at the time of cancellation. The amount forgiven is the remaining outstanding balance of accrued interest and principal on certain Direct LoansSM that are not in default. The information at Public Service Loan Forgiveness provides more detail on the subject.

Consolidation

In certain situations, students can consolidate their loans after graduation. The DOE provides more information on loan consolidation here.

Exit Counseling for Student Borrowers

Exit Counseling must also be completed before the student can receive a course completion certificate. The Exit Counseling can also be done on-line at www.StudentLoans.gov. Be sure to keep all of the entrance and exit counseling information, as this material will be needed when repayment begins.

The student is obligated to repay the full amount of the loan regardless of whether the borrower completes the Professional Pilot Program, is unable to obtain employment upon completion, is dissatisfied with the program, did not receive the educational (or other) services purchased from the MLH.

The National Student Loan Data System (NSLDS)

The DOE establish the NSLDS as a central database for student aid. This central database receives from several different areas (i.e. schools, guaranty agencies, the Direct Loan program, and other Department of ED programs). This comprehensive view of the Title IV loans and grants is accessible by students, and provided for inquiry of account data.

Website: http://www.nslds.ed.gov/nslds_SA/

Phone: 800.4.FED.AID (800.433.3243)

800.730.8913 (TDD)

The hours of operation are from 8AM to Midnight (EST), Monday through Friday, and 9AM to 6PM (EST) on Saturdays.

Contacting the Ombudsman’s Office

If a student is in need of help with disputes over their Direct LoansSM, they can contact the Federal Student Aid Ombudsman of the Department of Education.

Per the Federal Ombudsman’s website:

An ombudsman resolves disputes from a neutral, independent viewpoint. The Federal Student Aid (FSA) Ombudsman will informally conduct impartial fact-finding about your complaints. We will recommend solutions, but we don’t have the authority to reverse decisions. We will also work to bring about changes that will help prevent future problems for other student loan borrowers. This free service is provided by the US Department of Education.

The Ombudsman will research your problem and determine whether you have been treated fairly. If your student loan complaint is justified, we will work with you and the office, agency, or company involved in the problem. On your behalf, we will contact other offices within the U.S. Department of Education, your private lender, your loan guaranty agency, and the servicing agency or firm collecting your loan.

If your complaint is not justified, we will take the time to explain to you how we reached this conclusion.

The Ombudsman is not an advocate or someone who will automatically take your side in a complaint. We must consider all sides in an impartial and objective way. It’s the Ombudsman’s job to help develop fair solutions to complex and difficult problems.

Mailing Address: U.S. Department of Education

FSA Ombudsman

830 First Street, NE

Fourth Floor

Washington, DC 20202-5144

Phone Number: 877.557.2575

Fax Number: 202.275.0549

Website: www.ombudsman.ed.gov/start.html

Institutional Code of Conduct for Education Loans

Ethical considerations regarding student financial are important to the College. There are no revenue-sharing arrangements with any lender of any kind. The act of receiving gifts from a lender, a guarantor, or loan servicer is prohibited. There will be no contract arrangements providing financial benefit from any lender of affiliates of a lender. Loan certifications will not be delayed or refused, and the College prohibits the directing of borrowers to particular lenders. No funds will be offered as private loans. There is no financial aid assistance to call center or financial aid office staff.

Gramm Leach Bliley (GLB) ACT Information Security Plan

This Information Security Plan (“Plan”) describes Mauna Loa Helicopters’ safeguards to protect information and data in compliance (“Protected Information”) with the Financial Services Modernization Act of 1999, also known as the Gramm Leach Bliley Act, 15 U.S.C. Section 6801. These safeguards are provided to:

- Protect the security and confidentiality of Protected Information;

- Protect against anticipated threats or hazards to the security or integrity of such information; and

- Protect against unauthorized access to or use of Protected Information that could result in substantial harm or inconvenience to any customer.

This Information Security Plan also provides for mechanisms to:

- Identify and assess the risks that may threaten Protected Information maintained by Mauna Loa Helicopters;

- Designate employees responsible for coordinating the program;

- Design and implement a safeguards program;

- Manage the selection of appropriate service providers;

- Adjust the plan to reflect changes in technology, the sensitivity of Protected Information, and internal or external threats to information security; and

- Reference related policies, standards, and guidelines.

Identification and Assessment of Risks to Customer Information

Mauna Loa Helicopters recognizes that it has both internal and external risks. These risks include, but are not limited to:

- Unauthorized access of Protected Information by someone other than the owner of the covered data and information

- Compromised system security as a result of system access by an unauthorized person

- Interception of data during transmission

- Loss of data integrity

- Physical loss of data in a disaster

- Errors introduced into the system

- Corruption of data or systems

- Unauthorized access of covered data and information by employees

- Unauthorized requests for covered data and information

- Unauthorized access through hardcopy files or reports

- Unauthorized transfer of covered data and information through third parties

Mauna Loa Helicopters recognizes that this may not be a complete list of the risks associated with the protection of Protected Information. Since technology growth is not static, new risks are created regularly. Accordingly, the Administrative team will actively participate with and seek advice from an advisory committee made up of university representatives for identification of new risks. Mauna Loa Helicopters believes current safeguards used by the Administrative team are reasonable and, in light of current risk assessments are sufficient to provide security and confidentiality to Protected Information maintained by the flight school.

Information Security Plan Coordinators

The MLH Administrative team, is responsible for the maintenance of information security and privacy. The Administrative team is responsible for safeguarding Protected Information will provide an annual update report indicating the status of its safeguarding procedures. Then are responsible for assessing the risks associated with unauthorized transfers of Protected Information and implementing procedures to minimize those risks that are appropriate based upon the flight school’s size, complexity and the nature and scope of its activities.

Design and Implementation of Safeguards Program

Employee Management and Training

In accordance with MLH policies, standards, and guidelines, reference checking and background reviews will be conducted when deemed appropriate. During employee orientation, each new employee in departments that handle Protected Information will receive proper training on the importance of confidentiality of Protected Information. Each new employee will also be trained in the proper use of computer information and passwords. Further, each department responsible for maintaining Protected Information will provide ongoing updates to its staff. These training efforts should help minimize risk and safeguard covered data and information security.

Physical Security

Mauna Loa Helicopters has addressed the physical security of Protected Information by limiting access to only those employees who have a business reason to know such information and requiring signed acknowledgement of the requirement to keep Protected Information private. Existing policies establish a procedure for the prompt reporting of the loss or theft of Protected Information. Offices and storage facilities that maintain Protected Information limit customer access and are appropriately secured. Paper documents that contain Protected Information are shredded at time of disposal.

Information Systems

Information systems include network and software design, as well as information processing, storage, transmission, retrieval, and disposal. Mauna Loa Helicopters has policies, standards, and guidelines governing the use of electronic resources and firewall and wireless policies. Mauna Loa Helicopters will take reasonable and appropriate steps consistent with current technological developments to make sure that all Protected Information is secure and to safeguard the integrity of records in storage and transmission. Mauna Loa Helicopters will develop a plan to protect all electronic Protected Information by encrypting it for transit.

Management of System Failures

MLH will maintain effective systems to prevent, detect, and respond to attacks, intrusions and other system failures. Such systems may include maintaining and implementing current anti-virus software; checking with software vendors and others to regularly obtain and install patches to correct software vulnerabilities; maintaining appropriate filtering or firewall technologies; alerting those with access to covered data of threats to security; imaging documents and shredding paper copies; backing up data regularly and storing back-up information off site, as well as other reasonable measures to protect the integrity and safety of information systems.

Selection of Appropriate Service Providers

Due to the specialized expertise needed to design, implement, and service new technologies, vendors may be needed to provide resources that determines not to provide on its own. In the process of choosing a service provider that will maintain or regularly access Protected Information, the evaluation process shall include the ability of the service provider to safeguard Protected Information. Contracts with service providers may include the following provisions:

- A stipulation that the Protected Information will be held in strict confidence and accessed only for the explicit business purpose of the contract;

- An assurance from the contract partner that the partner will protect the Protected Information it receives.

Continuing Evaluation and Adjustment

This Information Security Plan will be subject to periodic review and adjustment, especially when due to the constantly changing technology and evolving risks. The administrative team will review the standards set forth in this policy and recommend updates and revisions as necessary. It may be necessary to adjust the plan to reflect changes in technology, the sensitivity of student/customer data and internal or external threats to information security.

Policies, Standards and Guidelines

Policies

- Background Verification

- Employee Conduct and Work Rules

- Privacy Rights of Students

- Release of Student Information

- Lost or Stolen Student Records

- Computer, Internet, and Electronic Communications

Guidelines

- Student Educational Records – FERPA

- ASU’s Privacy Statement

- Desktop and Network Security

- Personal Desktop Security for Home and Office

- Anti-Virus Updates and Utilities

- ASU Site-Licensed Software: Recommended Software

Mauna Loa Helicopters' Policy on the Disclosure of Directory Information

Purpose:

This policy outlines Mauna Loa Helicopter's stance on the disclosure of student directory information to third parties in accordance with the Family Educational Rights and Privacy Act (FERPA) and applicable state laws. This policy aims to protect student privacy and provide clear guidance regarding the handling of directory information.

Policy Statement:

Mauna Loa Helicopters values and prioritizes the privacy of our students. To that end, it is the policy of Mauna Loa Helicopters that student directory information will not be disclosed to third parties, including but not limited to commercial entities, external organizations, and individuals outside of the institution. This policy applies to all students currently enrolled at Mauna Loa Helicopters and covers information classified as "directory information" under FERPA.

Definition of Directory Information:

FERPA defines directory information as information contained in the education records of a student that would not generally be considered harmful or an invasion of privacy if disclosed. Common examples include, but are not limited to:

- Student's name

- Address

- Telephone number

- Email address

- Dates of attendance

- Enrollment status

- Degrees and awards received

Exceptions to Non-Disclosure Policy:

This policy does not restrict the institution from releasing directory information:

- As required by law, such as in response to a subpoena or court order.

- To authorized representatives of federal, state, or local educational authorities.

- In cases where disclosure is deemed essential for school safety or a specific institutional purpose.

Student Opt-Out Option:

In accordance with FERPA, students retain the right to opt out of the release of directory information for any purpose. Mauna Loa Helicopters will honor all student opt-out requests and refrain from releasing directory information for students who have exercised this right.

Request Denial and Appeal Process:

In instances where requests for directory information are submitted by third parties, Mauna Loa Helicopters will issue a formal denial in alignment with this policy. Appeals or inquiries about the denial should be directed to the Office of the Registrar or the institution’s designated FERPA compliance officer.

Policy Review and Amendments:

This policy will be reviewed annually and updated as necessary to comply with FERPA regulations and any changes in applicable state or federal law.

Contact Information:

For questions or additional information about this policy, please contact:

Mauna Loa Helicopters Admissions Office